FIRE a 30yr old with ₹1.5 Cr Corpus by 45

Planning a journey From struggle of EMIs and debt to Financial Freedom FOR REAL

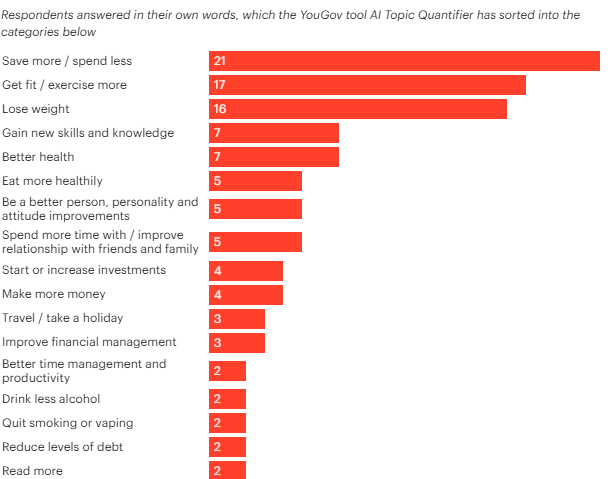

As 2025 approaches, it's that time again when people set ambitious New Year's resolutions—only to see them become memes a few weeks later.

Aside from going to the gym daily, one of the most common resolutions is to start saving, spend less, earn more, and invest money. However, just a few days in, we often end up acting like the monkeys below.

Our survey revealed that this often happens due to the following reasons:

A failure to see the bigger picture

General knowledge but no specific guidance

The absence of a clear plan

Lack of a support system to stay motivated

One thing is clear: we all need a plan and a little push to start managing our money. After much thought, we've decided to do all the hard work for you and anyone looking to sort out their RUPEE.

As our bade log (the elders) often remind us, "A smart person learns from their own mistakes, but a wise person learns from others’." Today, we’re going to do just that—learn from others’ financial decisions, status, and plans so you can sidestep their blunders and make smarter moves with your money.

Before starting to dive into today’s letter, let’s poll on a simple question, shall we?

Highlight for Today’s Letter

Financial makeover: Transforming a 30-year-old bachelor’s finances to build a ₹2 crore corpus by 45

Sneak peek on Next Week's Letter

1. Goal Defining

We’ve crafted this financial roadmap tailored to current income and expenses to help achieve this person’s financial goals effectively.

Time Horizons:

Short-term (0-3 years): Build a robust emergency fund and secure comprehensive insurance.

Medium-term (3-7 years): Focus on wealth creation through carefully selected investments.

Long-term (7+ years): Accumulate a corpus for financial independence (FI).

Risk Appetite

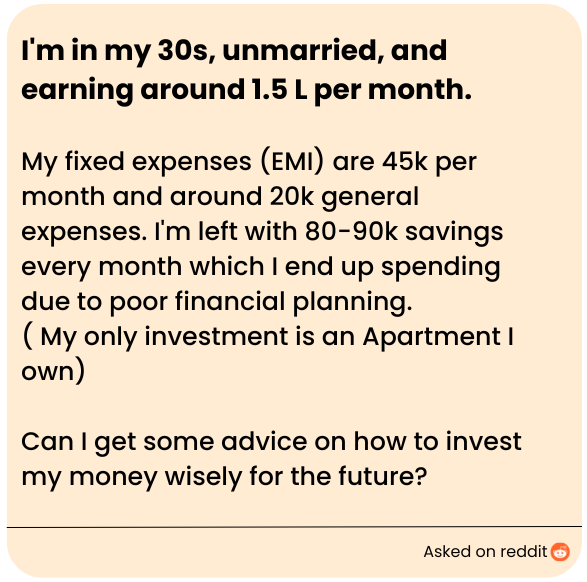

Current Financial Status

Income: ₹1,50,000/month

Expenses: ₹65,000/month (EMI + general expenses)

Savings: ₹85,000/month

Existing Investments: A real estate apartment

Dhiraj Thougths (Investment Expert at Rupeestop)

He’s demonstrated commitment by purchasing a flat and paying EMIs, signaling a readiness to take calculated risks for growth.

2. Financial Expert's Deductions

Emergency Fund:

He should create a fund that covers 36 months of expenses (₹23,40,000) to safeguard against unforeseen situations.

Insurance:

Health Insurance: He should secure savings by protecting against unexpected medical emergencies.

Term Insurance: It is recommended that he opt for coverage at least 10 times his annual income (₹1.8 crore) to ensure financial security for his family.

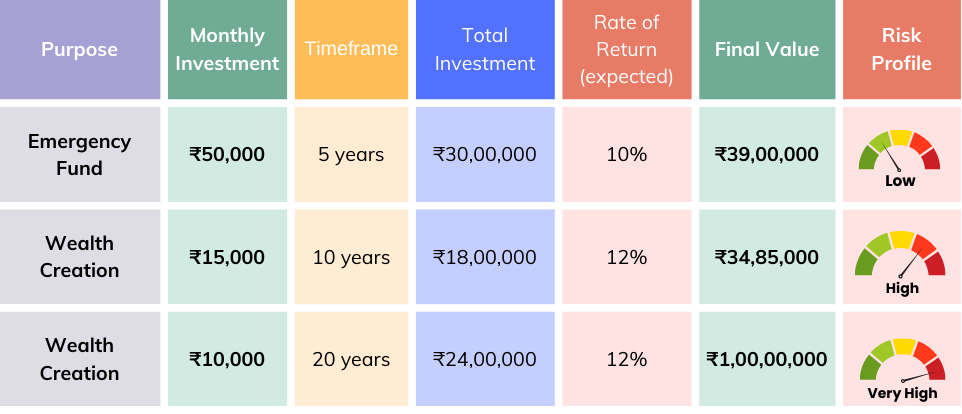

3. Let’s plan his investments

Considering his current salary, expenses, age, risk appetite, and other key factors, we've crafted a personalized plan perfectly suited to his financial goals.

Mohit adds (Investment Expert at Rupeestop)

We suggest one should not invest in Equities directly or through any instruments if one have investment horizon of less than 5-7 years.

4. Why we planned this for him

When we looked at his situation, we knew the first step was to ensure his financial security. By setting up an emergency fund and securing the right insurance, we’re giving him peace of mind, knowing he’s prepared for the unexpected.

Next, we turned our focus to wealth creation. With careful, systematic investments, we’re helping him build for the future—both in the medium and long term—so that he can confidently achieve his goals.

We also wanted to bring balance to the plan. By carefully allocating his resources, we aim to create stability while allowing for growth.

This plan isn’t just for today; it’s for the future he’s working hard to create.

💰 Want an investment strategy personalized to your goals?

5. What to Expect?

Investment Returns

5 Years (₹50,000/month)

At 10% returns: ₹39,00,000

This amount will cover your expenses and act as your emergency fund. If it remains untouched, we’ll shift it to equity investments to grow your long-term corpus.

10 Years (₹15,000/month)

At 12% returns: ₹34,85,000

This sum will help you achieve your medium-term goals, allowing you to build wealth while managing risks gradually.

20 Years (₹10,000/month)

At 12% returns: ₹1,00,00,000

At 15% returns: ₹1,51,60,000

This is your long-term wealth—left to grow and compound over the next two decades. By the time you reach this milestone, the power of compounding will have transformed your savings into significant wealth.

Bonus Advice: Avoid increasing your expenses, and gradually raise your SIP amount as your income grows to maximize returns6. Common Doubts Answered

Why Term and Health Insurance?

Term Insurance: It’s a safety net for your family, providing financial protection in case of unforeseen events, and ensuring they are taken care of when you’re not around.

Health Insurance: This safeguards your savings against unexpected medical costs, preventing them from being drained by sudden health emergencies.

Why an Emergency Fund for 36 Months?

An emergency fund covering 36 months of expenses gives you the peace of mind that you’ll have financial stability during tough times—job loss or other unexpected circumstances.

How Can I Increase My Returns?

Increase SIP amounts annually: As your income grows, so should your SIP contributions to maximize returns.

Stay invested for the long term: Let the power of compounding work for you by keeping your investments intact over time.

Consult an expert: Book an exclusive meeting with a financial expert (click here) who can potentially help you beat market returns and grow your wealth more effectively.

Line up for Next week

To get your personalized money plan for investment, growth, and expenses. Submit your query, we shall get it sorted by next week 🤷♂️

(be precise as much as you can about your query)